U.S. App Economy Update, 2022

By: / / 05.25.2022

Download PDFINTRODUCTION

The unprecedented challenge of the pandemic stressed crucial business and infrastructure systems in every country. Almost overnight, huge swathes of economic activity that relied on face-to-face interactions were forced into virtual mode. Individuals and businesses were suddenly dependent on the internet, their smartphones, and their mobile applications for critical daily activities like work, shopping, and communication with loved ones. The App Economy, already important, became an increasingly indispensable part of the real economy.

For the most part, the infrastructure of the global “App Economy” performed well under the strain. Existing mobile applications were able to respond to soaring demand without significant outages. App developers were able to quickly create new apps to meet the human and economic needs of the pandemic, and get them onto the Apple App Store, Google Play, and other app stores. Publishers launched 2 million new apps in 2021 alone. At both small and large companies, finding workers with App Economy skills — the ability to develop, maintain, and support mobile applications — became essential. Remote work and sales were critical to keeping businesses going. Even as the pandemic ebbs, many jobs and economic interactions are still remote, placing an increased premium on mobile communications. Health organizations have learned about the usefulness of telehealth apps. Banks and other financial companies are consolidating branches and doing more business remotely. Airlines and other transportation businesses rely on apps to communicate directly with their customers. And many restaurants, while thankful to be open for in-person patrons, still do much of their business by delivery.

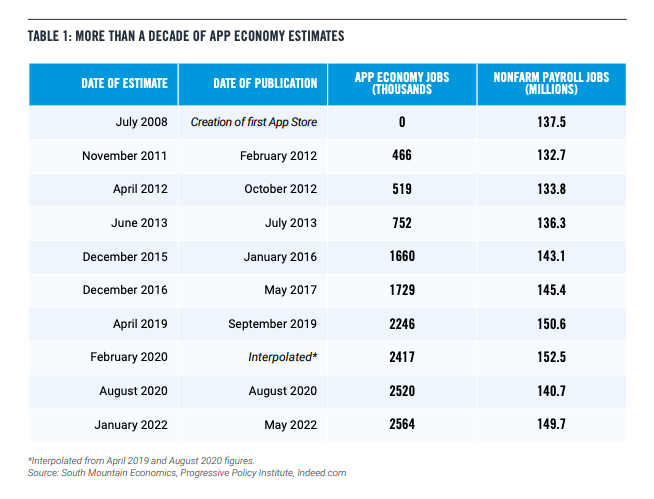

In the United States, as in other countries, the increased prominence of the App Economy was reflected in the growing number of jobs that required App Economy skills. We have been estimating the number of U.S. App Economy jobs since 2012, using detailed data on job postings as our major tool for analysis. Our latest estimate, as of January 2022, was 2.564 million App Economy jobs, including a conservative estimate of spillover jobs. That is up 14% from 2.246 million as of April 2019, and up 8% from an estimated 2.417 million as of February 2020. In this updated report, we also estimate App Economy jobs by operating system, and provide estimates of App Economy jobs for leading states. These state estimates are based on a new methodology that takes account of remote work.

METHODOLOGY

For this study, a worker is in the App Economy if he or she is in:

• An IT-related job that uses App Economy skills — the ability to develop, maintain, or support mobile applications. We will call this a “core” app economy job. Core app economy jobs include app developers; software engineers whose work requires knowledge of mobile applications; security engineers who help keep mobile apps safe from being hacked; and help desk workers who support use of mobile apps.

• A non-IT job (such as sales, marketing, finance, human resources, or administrative staff) that supports core app economy jobs in the same enterprise. We will call this an “indirect” app economy job.

• A job in the local economy that is supported either by the goods and services purchased by the enterprise, or by the income flowing to core and indirect app economy workers. These “spillover” jobs include local professional services such as bank tellers, law offices, and building managers; telecom, electric, and cable installers and maintainers; education, recreation, lodging, and restaurant jobs; and all the other necessary services.

We use public job postings from the Indeed realtime database of job postings to estimate the number of core App Economy jobs. We analyze job postings for App Economy jobs based on the national methodology described in our 2017 report, “U.S. App Economy Update.” Then we use a conservative multiplier of indirect and spillover jobs to estimate overall App Economy jobs.

Table 1 shows the full history of our estimates of the App Economy. (The February 2020 prepandemic figure represents an interpolated data point based on the April 2019 and August 2020 figures).

Measured against the size of the whole economy, the roughly 2.6 million workers in the App Economy represent about 1.7% of total nonfarm employment of nearly 150 million. That’s significant, but not overwhelming.

But we get a different perspective by looking at the App Economy’s contribution to job growth since Apple opened the first App Store in July 2008. From July 2008 to early 2022, the economy overall added roughly 13 million jobs, while the App Economy has gone from zero to 2.564 million jobs, including indirect and spillover jobs.

That implies that the App Economy has contributed about 20% of nonfarm job growth since its inception. Perhaps more important, the App Economy has been an “autonomous” source of hiring even while other parts of the economy have faltered.

APP ECONOMY BY OPERATING SYSTEM

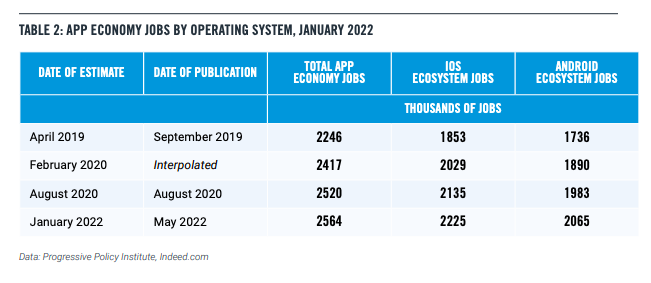

We can analyze App Economy job postings to see whether they refer to iOS- and/or Android-related skills. That allows us to assign App Economy jobs to either the iOS or Android “ecosystems” or both. For example, if a job posting is looking for an iOS developer without any mention of Android, then that job and the associated indirect and spillover jobs are part of the iOS ecosystem but not the Android ecosystem.

It needs to be noted that many App Economy job postings, especially in the United States, refer to both iOS and Android skills. A job posting might explicitly be directed at finding an Android software engineer, for example, but part of required or preferred experience might include previous development of either iOS or Android apps. As a result, most App Economy jobs in the U.S. belong to both the iOS and Android ecosystems. That isn’t necessarily true in other countries.

Table 2 below reports on iOS and Android ecosystem jobs as of January 2022. The iOS ecosystem included 2.225 million jobs, including indirect and spillover jobs. The Android ecosystem includes 2.065 million jobs.

This implies that the growth of the iOS ecosystem accounts for about 17% of nonfarm payroll job growth from July 2008 to January 2022. Similarly, the growth of the Android ecosystem accounts for about 16% of nonfarm payroll job growth from July 2008 to January 2022. Note that these figures are not additive.

LOCATION OF JOBS

Previous to the pandemic, our App Economy reports and updates generally included estimates of App Economy jobs by state. This was possible because, pre-pandemic, most job postings specified a location for the job. We were therefore able to distribute App Economy jobs by state and even by metro area.

The likely permanent rise of remote work means that the previous methodology no longer is sufficient. Many App Economy job postings now say “remote from” some city, meaning that the worker can be located anywhere, even if they have an “official” location. Let’s call these “tethered remote” jobs. Some job postings don’t even specify a home base, opting for “United States” or just “remote.” Let’s call these “untethered remote.” In addition, many jobs are now advertised as being based in any one of a number of different locations.

In this section we will describe a new preliminary methodology for estimating the job market impact of the App Economy by state. First, it is important to realize that this new methodology gives state estimates that are noncomparable to previous years. Second, this is a preliminary methodology and will likely change in future updates as we better understand the nature of remote work.

Recall that we divide App Economy jobs into core, indirect, and spillover jobs. Remote work means that the core jobs (such as app developers, mobile app security specialists, mobile app tech support staff) need not be in the same location as the indirect jobs (such as accounting, legal, marketing, and management). Spillover jobs (local service jobs, such as restaurants and retail, conservatively estimated) should be distributed according to the location of the core or indirect jobs.

The first step in our preliminary methodology involves searching for all job postings that contain either the term iOS or Android nationally and by state. We also identify the number of job postings that are “tethered remote.”

• Core App Economy jobs that have a location and are not remote are allocated to that location, along with the resulting indirect and spillover jobs.

• Core App Economy jobs that have a location and are “tethered remote” are allocated according to a two-step process. First, the associated indirect jobs and spillover jobs are allocated to the reported location. Second, the tethered remote core jobs are allocated by state according to the distribution of employment and jobs growth in NAICS 5415 (“computer systems design”), which is the industry where most app developers are found.

• Core App Economy jobs which have no location (“untethered remote”) are allocated by state according to the distribution of employment and jobs growth in NAICS 5415. In addition, the associated indirect and spillover jobs are allocated the same way.

Under the new methodology, California is still first on the list with 408, but the gap between California and other states has narrowed. California is followed by Texas, Washington, New York, Florida, Pennsylvania, Illinois, Virginia, and Georgia.

READ THE FULL REPORT